By Brendan Frazier

It’s the question buzzing in headlines, boardrooms, and client conversations: Can AI be trusted—and is it coming for your job?

For Financial Advisors, the rise of tools like ChatGPT and other AI-powered platforms has reignited an age-old debate. We’ve seen it before with robo-advisors and fintech platforms, but this time feels different. The technology is smarter. The adoption is faster. And the line between “support tool” and “trusted guide” is blurrier than ever.

Many Advisors are asking: If clients grow comfortable trusting AI, where does that leave us?

That question is bigger than technology, efficiency, or even innovation. Clients might use AI every day, but do they trust it to replace you? And if they do… what does that mean for your role as an Advisor?

Let’s explore what clients really think about using AI in financial decisions, why the human element still matters (and always will), and how you can use AI strategically without losing your edge.

Do Clients Trust AI?

Trust in AI isn’t as simple as “yes” or “no.” Most people rely on AI more than they realize:

- Your GPS reroutes you to avoid traffic? That’s AI.

- Spotify builds a playlist that hits the mood just right? That’s AI.

- Your bank flags a fraudulent charge before you notice it? Again, AI.

But there’s a gap between trusting AI to do tasks and trusting it to deliver guidance. Clients may welcome AI tools that support their experience, but they still crave a human relationship to make meaning from that data.

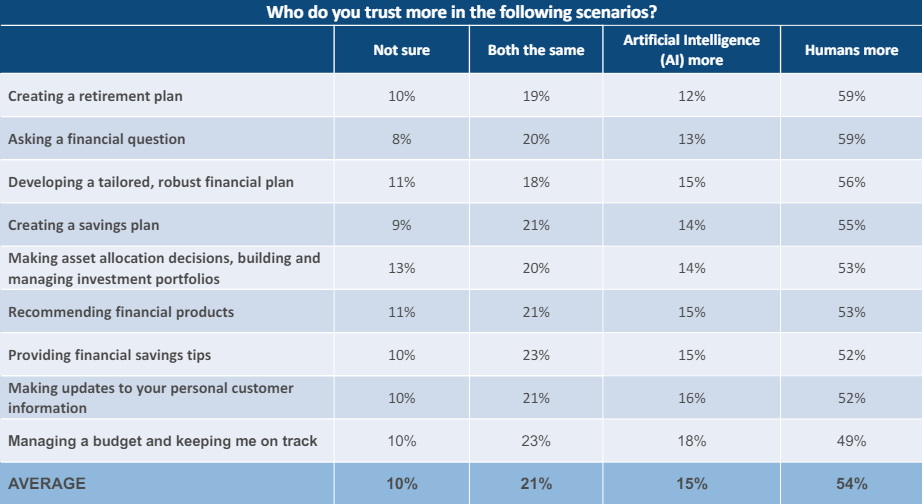

A recent study from Northwestern Mutual asked clients who they trust more—humans or AI—in various financial scenarios. Here’s what they said:

The majority of respondents trust humans more across all scenarios, with just an average 15% of respondents saying they trust AI more.

That’s a clear signal: Clients still want a person to guide them.

They may want AI to help with background tasks, calculations, or simple updates. But when it comes to building a retirement strategy, asking questions, or shaping a life plan, they trust:

- Empathy during life transitions

- The ability to ask “what if” and get a thoughtful answer

- A guide who knows them and is willing to challenge them

And that’s exactly where you deliver.

Meet Garry Kasparov

In 1997, world chess champion Garry Kasparov lost to IBM’s supercomputer, “Deep Blue.” It was a historic moment, proof that a machine could outmaneuver one of the smartest minds on Earth.

But Kasparov didn’t walk away. Instead, he began exploring how humans and machines might work together. In future tournaments, he introduced teams that paired human players with computers, testing a hybrid model of intelligence.

The result? The winning team wasn’t the world’s best supercomputer or a reigning grandmaster. It was a pair of amateur players using average machines, with one major advantage: They knew how to guide the tech.

That’s your advantage as a Financial Advisor. AI can generate output.

But you provide the strategy and emotional intelligence. And when you know how to confidently integrate technology into your human-first approach, you don’t just compete. You stand apart.

Digging Into the Data: What Do Clients Actually Want From Their Financial Technology?

The potential for technology like AI to deliver the technical aspects of financial advice faster, cheaper, and more reliably is significant. In many ways, AI may continue to evolve quickly in terms of speed, capability, and affordability.

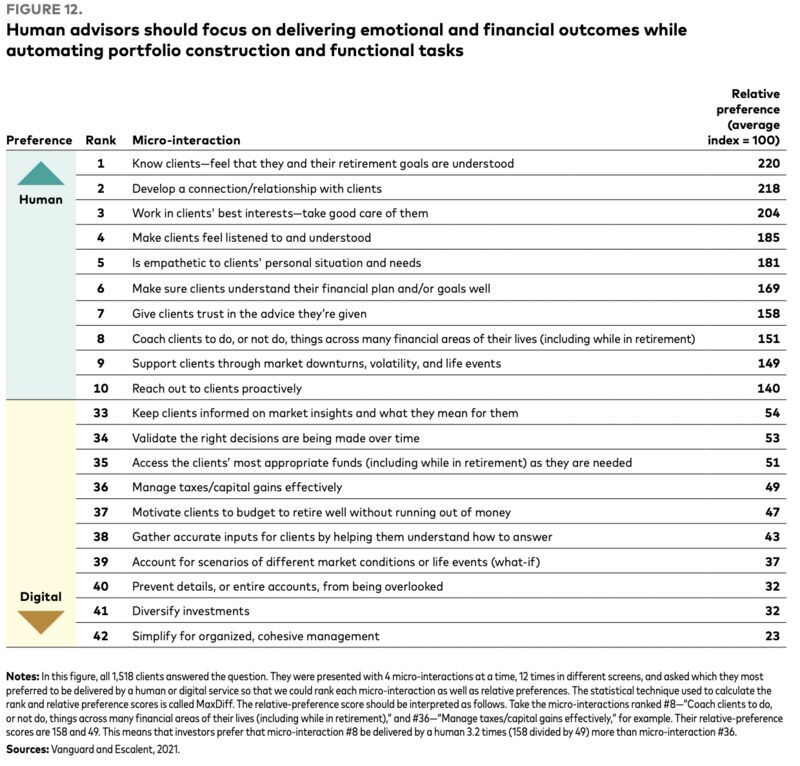

To explore how this technology revolution is impacting clients, Vanguard conducted a study that asked investors which services they’d rather receive from technology and which from a human Advisor.

Here’s what clients said they want from an Advisor:

- To feel understood as a person, not just a portfolio

- A real connection and relationship

- Trust in the advice they’re given

- Empathy for their unique life circumstances

- Accountability and coaching to follow through

These are things AI can’t replicate: It can’t look a client in the eye and build trust, help someone navigate a difficult life event with empathy, or motivate someone to change their behavior in pursuit of their goals.

(At least not at this point. We’ll save the discussion on whether it will eventually be capable of an equivalent human interaction for another article!)

Emotional cues don’t hold value in spreadsheets. They live in conversations and in the relationships that grow over time between you and your clients. AI can help power that work, but it will never replace the reason clients keep showing up for the conversation: you.

Related: The Art of Relationship-Building With Advisory Clients

Embracing AI as a Growth Strategy: 10 Smart Ways Advisors Can Use AI (Without Losing the Human Touch)

So, where does that leave you as an Advisor? With a powerful opportunity.

AI isn’t here to take your place; it’s here to enhance the way you work. Used strategically, it can help you streamline tasks, uncover insights, and create more space for building trust, guiding behavior, and delivering personalized advice.

Here are 10 practical ways to start using AI in your business—without losing the human touch that sets you apart.

1. Internal Process Documentation

Use AI to generate SOPs (standard operating procedures) for internal processes like onboarding, billing, or quarterly reviews.

2. Email Drafting

Speed up client communication with AI-generated email templates you can personalize for tone, timing, and relevance. (Note: Keep in mind any and all regulatory requirements and procedures for compliant communication when using AI tools to draft client-facing content).

3. Continuing Education Suggestions

Use AI to recommend CE courses, webinars, or conferences based on your business goals and evolving client needs.

4. Time Blocking & Schedule Optimization

AI calendar tools can rearrange your day based on workload and urgency—, keeping your time focused and flexible.

5. Team Meeting Recaps

Record and transcribe internal meetings, then have AI summarize key action items and decisions for the team.

6. Content Creation for Marketing

Draft blogs, captions, or talking points using AI tools, then refine the message to reflect your authentic voice.

7. Social Media Idea Generation

Use AI to brainstorm post ideas, hooks, and hashtags that keep your brand consistent and visible across platforms.

8. Client Survey Insights

Use AI to analyze responses from client satisfaction or onboarding surveys to uncover themes or concerns.

9. Event Planning Support

Generate task lists, schedules, or marketing copy for client appreciation events or webinars.

10. Personal Time Management Reports

Let AI analyze your calendar and produce a weekly report of where your time is going (and how to shift it toward high-value tasks).

Ready to Lead With Trust in the Age of AI? Meet The Human Side of Money

When clients have questions about AI, they’re looking to you for the answer.

You’re uniquely positioned to provide clarity, not just around technology, but around the emotional and behavioral needs your clients bring to the table.

That’s why we created the Wired Advisor newsletter, a resource for Advisors who want to better understand how human behavior, trust, and communication shape the value of their advice.

Each month, you’ll receive a roundup of educational video content, new podcast episodes, and the latest behavioral psychology insights, all designed to help you deliver advice with deeper impact. Click here to subscribe to Wired Advisor.Click here to subscribe to Wired Advisor.

Explore New Possibilities With RFG Advisory

At RFG, we partner with growth-minded Independent Financial Advisors who want to lead with innovation and human connection. If you’re looking for a platform that supports both cutting-edge technology and the behavioral coaching needed to stand out in the age of AI, we’d love to connect.

Technology might change how advice is delivered. At RFG, we help Advisors redefine what advice means. Schedule a call today.