By Brendan Frazier

As a Financial Advisor, very few decisions in your career can feel as high stakes as a transition or launching your own advisory business. Even if you’re confident it’s the right move, there’s one looming question that tends to stick:

“Will my clients come with me?”

Many Financial Advisors (nearly 50%) worry that their clients won’t follow them during a transition. However, at least one recent study (and some industry recruiters) report that the majority of clients are likely to follow their Advisor to a new firm.

Fear of client loss is valid. But it’s not inevitable.

The key variable? How you communicate the change.

Clients don’t follow platforms. They follow people. If they’ve built a relationship with you grounded in care and consistency, that trust can carry more weight than any account login or product lineup. What you say (and how you say it) can often determine whether clients feel confident moving forward with you or if they’re unsure about staying at all.

This guide walks you through strategies designed to help you speak with confidence and empathy during a Financial Advisor transition—so you can protect relationships, minimize disruption, and keep momentum moving forward.

| Please Note: Before you speak with clients, it’s critical to understand the legal guardrails around your move. The regulatory considerations tied to a Financial Advisor transition are highly specific, and even a well-intentioned conversation can trigger costly consequences for you and your new firm. It’s essential to consult legal counsel who understands the nuances of Advisor transitions to confirm any language guidelines both before and after a transition. |

The Real Difference: Trust vs. Transaction

During a transition, your clients aren’t just reacting to change; they’re responding to the kind of relationship they have with you.

If the connection has been primarily transactional—based on tasks, tools, or convenience—they may view your move as a disruption. But when the relationship is rooted in trust, the conversation often shifts.

Every client relationship should move toward partnership. Not surface-level service or product delivery, but real connection that’s built over time, reinforced through consistent communication, and tested in moments like this.

Before you call your clients, ask yourself: Am I showing up as a service provider—or as a trusted partner?

Thinking About a Strategic Business Move? Here’s How to Talk to Clients During a Financial Advisor Transition

Step 1: Get Inside the Client’s Mind

When you’re a Financial Advisor changing firms, it’s natural to focus on how the move benefits your business: more autonomy, better tools, a platform that fits your vision. But your clients aren’t thinking about any of that.

According to neuroscience research, people are significantly more likely to encode and retain information when it’s framed in personal relevance. When you explain how your transition helps them (e.g., better service, greater attention, more aligned incentives), they may listen more attentively and may feel more comfortable in making the transition with you.

A few questions that may be on the client’s mind during a Financial Advisor transition:

- “What does this mean for me?

- “What’s going to change?”

- “How will I benefit from this unexpected change?”

- “How does this affect my money, our relationship, and my experience?”

As you prepare your messaging, ask yourself:

“If I were the client, what would I want to know about how this impacts me, practically, emotionally, and financially?”

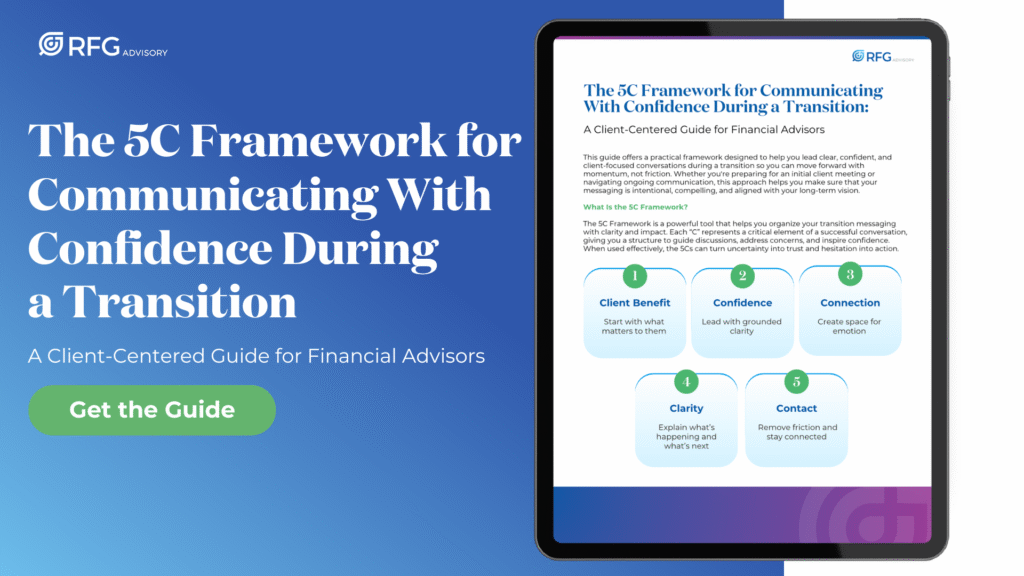

Step 2: Use the 5C Framework

When you’re a Financial Advisor making a strategic move in your business, how you talk about the change can carry just as much weight as the move itself. A well-planned transition can fall flat if the message feels unclear, rushed, or self-focused.

Try using the 5C Financial Advisor Transition Conversation Model—a framework designed to guide meaningful, client-centered conversations during times of change. Here’s how it works:

- Client Benefit: What’s in it for them?

Change introduces uncertainty, no matter how well a client knows you or how strong your relationship is. When they hear you’re leaving your firm, their brain doesn’t immediately think about what’s best for you. It leaps to, “How does this affect me?”

Take a look at this example of two different ways to communicate this message, one Advisor-centric and the other client-centric:

| ❌ “I’ve decided to leave ABC Financial to start my own firm. I’ve wanted more independence and control over the way I run my practice.” |

| ✅ “I’ve made a move that allows me to serve you with greater flexibility and better technology—without being constrained by a big firm’s red tape. It means more personal, tailored service for you.” |

Use this formula:

- “I made a move…”

“…that allows me to (insert benefit to client)…”

“…so I can better (insert client-specific outcome).”

The more directly you tie the transition to their goals, the more confident they’ll likely feel moving forward with you.

- Confidence: Why are you doing this?

The tone of the message often shapes how the client feels about the move more than the content itself. You could say all the right things, but if your delivery signals uncertainty, clients will likely feel uncertain, too. A confident tone signals:

- “I made this move thoughtfully and strategically.”

- “You’re in good hands.”

- “This transition is a positive step forward.”

Here are two messages with the same content and completely different tones:

| Example 1 (What Not To Do): “Hey, I wanted to let you know I’ve decided to leave my firm. I know this might come as a surprise, and I hope it doesn’t disrupt anything for you. I think it could be really beneficial for me. I hope you’ll consider continuing to work with me, but I completely understand if you have concerns about it.” |

| Example 2 (The Client-Centric Approach): “I wanted to personally share some exciting news. I’ve made the decision to move to a new firm that aligns more closely with how I want to serve you—more flexibility, more independence, and better tools to support your goals. This change reflects a lot of careful planning to make it as seamless as possible for you.” |

Notice how the second one is filled with confidence and certainty that your clients need to hear from you.

- Connection: How are they feeling?

In the rush to convey the exciting news to all of your clients, it’s easy to overlook one of the most important parts of the conversation: giving the client a safe space to process and express their own feelings.

This is something you were likely dwelling on and processing for months (or even years). But for your clients, this is an unexpected and sudden change in their lives that can generate a lot of emotions. It’s essential to meet those emotions with empathy and understanding.

First, acknowledge the situation: “I know this might come as a surprise, and you may have some questions or mixed feelings about it—that’s completely normal.”

Then, ask an emotional check-in question:

- How are you feeling about all of this?

- What’s your initial reaction to this news?

- What questions or concerns are on your mind?

Taking a moment to pause and meet emotion with empathy could help make your transition more impactful.

- Clarity: What’s happening?

Even clients who fully trust you may feel some degree of uncertainty when you switch firms. When clients ask, “So what exactly is going on right now?,” you need a clear, confident response.

Here’s one way to frame the process:

- Accounts Are Being Aligned: Your current account information is being reviewed and prepared for transfer to the new custodian.

- Paperwork Is Personalized: Documents are tailored to your setup to avoid duplication or unnecessary steps.

- Your Preferences Are Top of Mind: We’re working to reflect how you’ve historically managed your financial life, down to communication and transaction preferences.

- Access Is Being Prepped: Technology, portals, and secure credentials are being configured, so your experience feels familiar and intuitive.

- We’ll Keep You Informed: You’ll hear from me directly at key points. If anything needs your attention, I’ll make that clear.

This approach centers on what matters most to the client: knowing they’re being looked after. It conveys a sense of progress without locking you into rigid timelines or specific outcomes. By delivering updates clearly and calmly, you reinforce your role as their trusted point of contact throughout the transition.

The goal isn’t to overexplain every detail, it’s to keep clients informed in a way that feels intentional, reassuring, and free of unnecessary complexity.

- Contact: Where can they find you?

You can craft the perfect message, reassure your clients, and explain all the benefits of your move, but if they don’t know how to reach you at your new firm, none of it may matter. Not to mention that any unnecessary friction can decrease the likelihood of a client making a move.

Ask if they prefer email, phone, or both, and then provide them with their choice. After that, you may also want to include:

- New firm name

- Website

- Social Media

- Mailing Address

This isn’t just logistics; it’s the bridge between your past and your future relationship.

Step 3: Practice

At this point, you have the framework necessary to deliver a confident, client-centric message about your Financial Advisor transition. But here’s where many Advisors fall short: They treat their first few client calls like a rehearsal to refine the message.

Don’t practice on your clients! Just like you wouldn’t give a keynote speech without rehearsing it, you shouldn’t step into one of the most important client conversations of your career without practice.

Why Practicing Matters:

- Reduces mental load and increases confidence.

- Sharpens your message to eliminate rambling.

- Builds trust through composed, clear delivery.

Practice Tactics:

- Write a bullet-point outline using the 5C structure

- Rehearse aloud at least three to five times

- Record yourself and adjust for tone

- Roleplay with a colleague, friend or family member

Here’s an assessment to let you know once you’re ready to start calling clients:

| Category | What You’re Evaluating | Your Score (1–5) | Reflection Prompt |

|---|---|---|---|

| Clarity of Message | Did I clearly explain what’s happening and why? | What felt confusing or overly detailed? Could a client repeat this back in one sentence? | |

| Client Benefit (WIIFM) | Did I focus enough on how this benefits the client—not just me? | Did I use “you” more than “I”? Did I name at least 2 client-facing advantages? | |

| Tone and Presence | Did I sound confident, calm, and grounded—or rushed, apologetic, or unsure? | Would a client feel reassured after hearing this? Did I pause and breathe? | |

| Empathy and Listening | Did I create space for how the client might be feeling? | Did I invite them to share their thoughts or concerns? Did I show I care? | |

| Handling Objections | Am I prepared for common questions like: “Why did you leave?” or “Is this safe?” | Which objections caught me off guard? What do I still need to script out or rehearse? | |

| Next Steps and Process | Did I explain what happens next and how simple it is for them? | Did I reference paperwork, timeline, or what they can expect in the coming days? | |

| Call to Action | Did I ask them to take the next step or reaffirm our continued relationship? | Did I say something like, “I’d be honored to continue working with you”? |

Total Score (out of 35): _____

- 29–35 = 🟢 Strong & ready (Final polish only)

- 21–28 = 🟡 Solid, but room to refine (Practice with a peer or coach)

- < 20 = 🔴 Needs work (Clarify your story and rehearse more intentionally)

Step 4: Develop A Communication Strategy

Once you’ve crafted your message and practiced delivering it with clarity, empathy, and confidence, the next critical step is executing the communication plan.

You need a clear strategy that answers:

- Who are you contacting?

- In what order?

- Through which method? (Phone, email, in-person, video?)

First, it’s time to crunch the numbers. Add up:

- Number of clients

- Estimated time per call (15-30 minutes)

- Number of contacts per day you plan to contact

- Number of days required to complete the work

If, in your calculations, you determine that you simply don’t have the time to call all of your clients, then you can personalize your email by providing the option to set up a call to connect. If you go this route, you can also send a pre-recorded video that explains what you would say if you were in person.

Pro Tip: Don’t start with your biggest client. When it’s go-time, resist the urge to lead with your largest or most complex relationship. Your early reps are still part of your learning curve, and those first few conversations help you refine your delivery in real time.

Start with clients who:

- You have strong trust and rapport with

- You feel most comfortable engaging in an honest, candid conversation

This gives you room to build momentum (and confidence) before higher-stakes discussions.

Step 5: Follow a Framework

This script isn’t meant to be copied word for word. It’s here to help you organize your thoughts and deliver a message designed to build trust. Make it your own and you’ll sound more natural, authentic, and confident.

“I wanted to personally share some important news with you: I’ve decided to leave [Current Firm] and launch/join [New Firm]. This change is effective [Date]. This wasn’t a decision I made lightly. My guiding light throughout my career is has been a focus on serving my clients at the highest level. And it started to become clear that I needed a platform that offered more independence, flexibility, and customization.

Here’s what this means for you: you’ll get the same high-level service and quality of advice that you’ve been getting, but we’ll have better tools, better technology, and the ability to provide a more personalized level of service.

And while I’ve been thinking about this for a while, I know this may come as a surprise to you. I’d love to hear what you’re thinking, and any questions coming to mind?”

—–Empathize and Answer Questions—–

“We’ve already built out a process to ensure this experience is as seamless and painless as possible for you. Would it be helpful if I walk through the steps? What should I expect?”

——Walk Through the Process——

“Lastly, obviously my contact information has changed, and I want to make sure you know how to reach me at all times. Do you prefer phone, email or both?”

A Financial Advisor Transition: Communicate the “Why” to Your Clients With Confidence

Making a move to a new firm isn’t just a business decision; it’s a defining moment in your growth as an Advisor. This guide gave you the tools. You’ve got the framework. Now it’s about showing up for your clients in a way that reflects everything you’ve built.

RFG’s systematic transitions method is designed to help you move client assets efficiently and seamlessly. With comprehensive transitions support, you’ll have access to:

- Customized, end-to-end account mapping and moving processes, allowing you to concentrate on client relationships

- Marketing support designed to reflect your values and tell your story

- Guidance on custodial tools and technology, so you can feel ready instead of rushed

Want support crafting your message or mapping your communication plan? Reach out to our team to connect or explore how RFG’s transition services help Advisors like you launch their business on a platform built for growth.